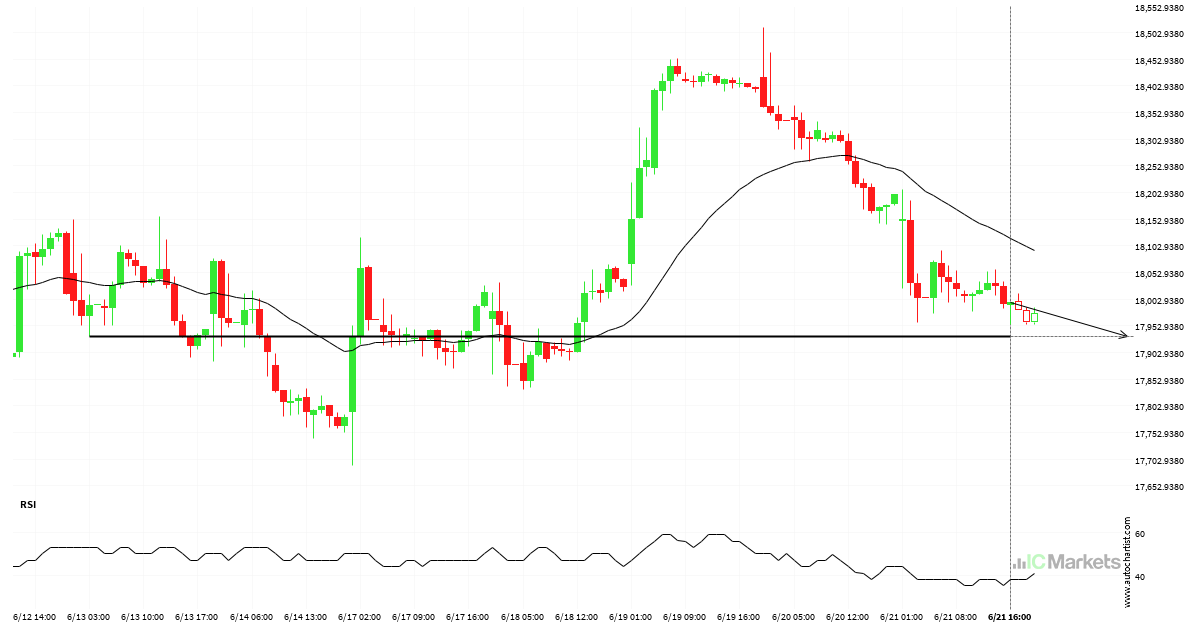

Hong Kong 50 Index short term bearish trade setup to 17933.6699

Hong Kong 50 Index is heading towards 17933.6699 and could reach this point within the next 2 days. It has tested this line numerous times in the past, and this time could be no different, ending in a rebound instead of a breakout. If the breakout doesn’t happen, we could see a retracement back down […]

Is FTSE China A50 Index likely to correct after this massive movement?

FTSE China A50 Index has experienced an exceptionally large movement lower by 1.52% from 12215.32 to 12030.07 in the last 2 days.

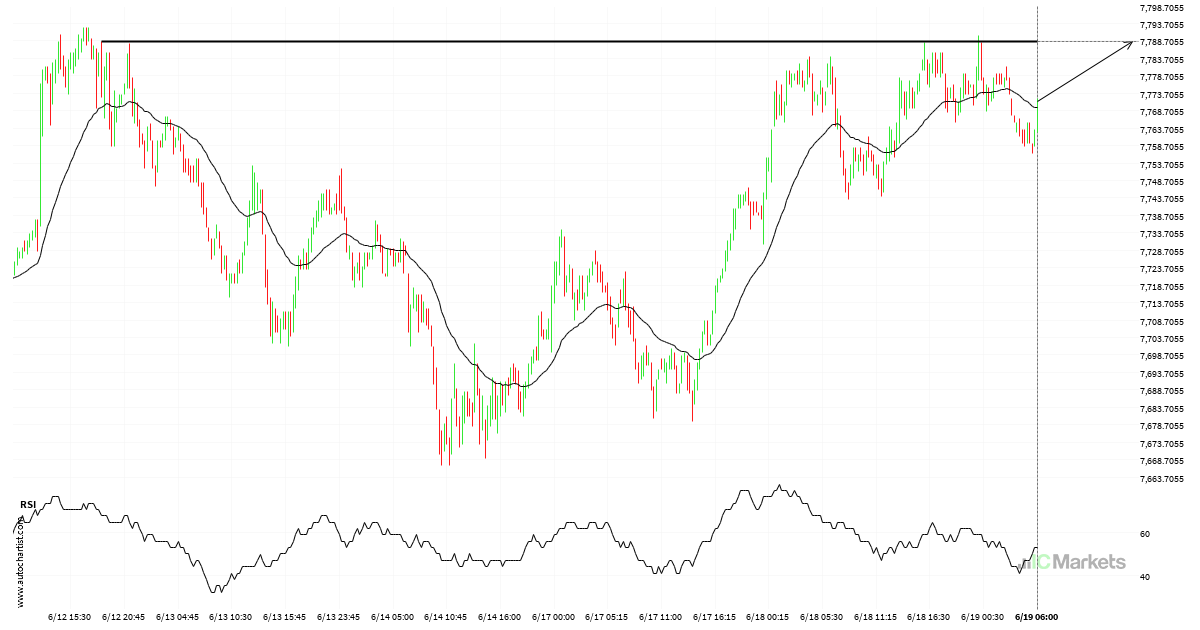

Australia 200 Index short term bullish trade setup to 7788.4399

The movement of Australia 200 Index towards 7788.4399 price line is yet another test of the line it reached numerous times in the past. We could expect this test to happen in the next 23 hours, but it is uncertain whether it will result in a breakout through this line, or simply rebound back to […]

Should we expect a bullish trend on Hong Kong 50 Index?

The breakout of Hong Kong 50 Index through the 18034.0391 price line is a breach of an important psychological price that is has tested numerous in the past. If this breakout persists, Hong Kong 50 Index could test 18166.9141 within the next 9 hours. One should always be cautious before placing a trade, wait for […]

FTSE China A50 Index – Continuation Chart Pattern – Channel Down

FTSE China A50 Index is trapped in a Channel Down formation, implying that a breakout is Imminent. This is a great trade-setup for both trend and swing traders. It is now approaching a support line that has been tested in the past. Divergence opportunists may be very optimistic about a possible breakout and this may […]

Will Hong Kong 50 Index have enough momentum to break support?

An emerging Falling Wedge has been detected on Hong Kong 50 Index on the 4 hour chart. There is a possible move towards 17694.4094 next few candles. Once reaching resistance it may continue its bearish run or reverse back to current price levels.

Australia 200 Index – getting close to resistance of a Channel Up

Australia 200 Index was identified at around 7776.44 having recently rebounded of the support on the 4 hour data interval. Ultimately, the price action of the stock has formed a Channel Up pattern. This squeeze may increases the chances of a strong breakout. The projected movement will potentially take the price to around the 7909.2667 […]

Should we expect a breakout or a rebound on FTSE China A50 Index?

FTSE China A50 Index was identified at around 12192.73 having recently rebounded of the resistance on the 1 hour data interval. Ultimately, the price action of the stock has formed a Falling Wedge pattern. This squeeze may increases the chances of a strong breakout. The projected movement will potentially take the price to around the […]

Rare opportunity on FTSE China A50 Index – extreme bearish movement

FTSE China A50 Index hits 12210.88 after a 1.54% move spanning 12 hours.

Where is Hong Kong 50 Index moving to?

Trend followers are probably eagerly watching Hong Kong 50 Index to see if its latest 5 consecutive candles continues. If not, the mean-reversion people out there will be delighted with this exceptionally large 20 hours move.